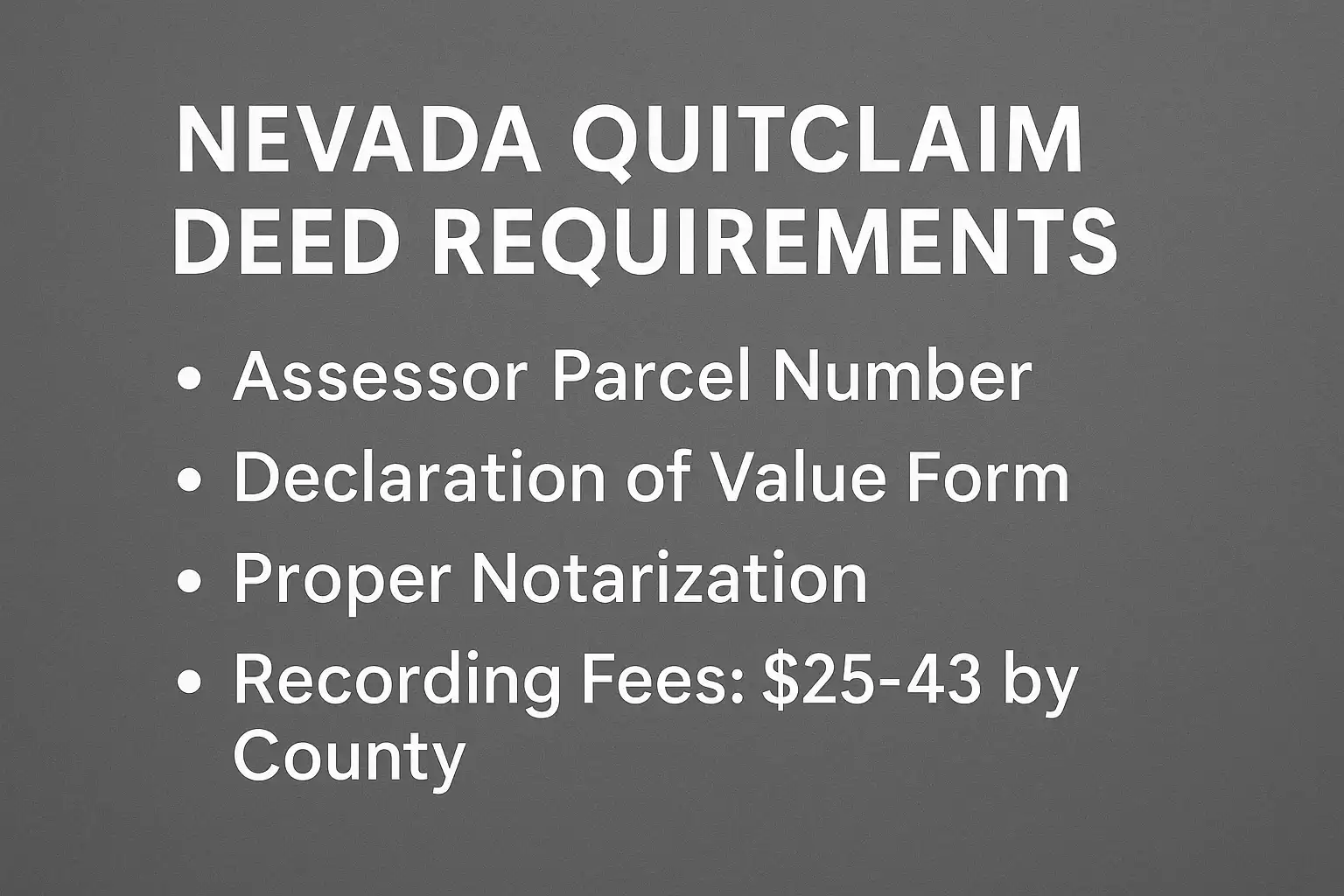

Nevada requires quitclaim deeds to include assessor parcel numbers, Declaration of Value forms, and proper notarization. Recording fees vary by county ($25-43), with Real Property Transfer Tax at $1.95 per $500 of value (plus county supplements). Nevada is a community property state with immediate recording in Clark County, making it ideal for Las Vegas market transactions.

Introduction: Understanding Nevada’s Dynamic Property Transfer Environment

Nevada’s unique position as a rapidly growing state with major metropolitan areas like Las Vegas and Reno creates distinctive property transfer opportunities and challenges. The state’s approach to quitclaim deeds combines traditional real estate law with specific requirements designed to accommodate both the fast-paced Las Vegas market and Nevada’s community property laws, making efficient property transfers essential for the state’s diverse real estate landscape.

Key Characteristics of Nevada’s Legal Framework

Nevada operates under a comprehensive statutory framework found in Nevada Revised Statutes (NRS) Chapters 111 and 375, which govern property transfers and taxation. Nevada’s Administrative Code defines a quitclaim deed as “a deed of conveyance operating by way of release, that is, intended to pass any title, interest or claim which the grantor may have in the premises, but not professing that the title is valid nor containing any warranty or covenants for title.”

The state’s approach emphasizes efficiency and clarity while providing robust protections for both parties. Nevada title companies routinely insure title passed by quitclaim deed, making Nevada more quitclaim-friendly than some other states where title insurers are reluctant to provide coverage for quitclaim transfers.

Nevada’s Community Property System

Nevada is one of nine community property states in the United States, which significantly impacts quitclaim deed transactions involving married couples. Nevada is a community property state, meaning that spouses have additional rights with regard to anything acquired during the marriage. This system requires careful attention to spousal consent and property characterization in quitclaim deed transactions.

When Quitclaim Deeds Excel in Nevada

Nevada courts and real estate professionals recognize quitclaim deeds as particularly effective for:

- Las Vegas real estate transactions: Fast-paced market requiring efficient transfer methods

- Community property transfers: Between spouses or for property characterization

- Family property transfers: Especially common in Nevada’s multigenerational families

- Divorce property settlements: Streamlined property division under community property law

- Trust and estate planning: Moving property into family trusts or business entities

- Title correction purposes: Resolving clouds on title or ownership disputes

Las Vegas Market Considerations

The Las Vegas metropolitan area represents a significant portion of Nevada’s real estate activity, with unique market characteristics that benefit from quitclaim deed efficiency. In Clark County (which includes Las Vegas, Henderson, Boulder City, North Las Vegas and Mesquite), the County Recorder instantly records the deed and hands it back, providing immediate confirmation of transfer completion.

Ready to create your Nevada quitclaim deed? Deeds.com offers county-specific Nevada quitclaim deed forms accepted by all 17 Nevada county recorders. Get your Nevada Quitclaim Deed Form →

Legal Requirements: Nevada State Statutes and Essential Elements

Statutory Foundation and Core Requirements

Nevada’s quitclaim deed requirements are established in NRS Chapter 111, with specific formatting and content requirements detailed throughout the statutes. The legal description of the property, the names and addresses of the grantor and grantee, the monies due to the grantor, and the notarized signature of the grantor are the minimum requirements for all counties.

Mandatory Content Requirements:

- Grantor identification: Complete legal name and current address

- Grantee identification: Full legal name and mailing address

- Property description: Accurate legal description per NRS requirements

- Consideration amount: Specific monetary consideration (may be nominal)

- Assessor’s parcel number: Required by NRS 247.110 in specific location

- Tax statement address: Name and address for future property tax statements

- Date of execution: Complete date of deed signing

- Notary acknowledgment: Proper notarization by authorized officer

Assessor Parcel Number Requirements

A grant bargain or deed of sale, Quitclaim deed, Warranty deed or Trustee’s deed upon sale needs to contain the name and address of the person to whom a statement of the taxes assessed on the real property is to be mailed. Additionally, the assessor’s parcel number must appear at the top left corner of the first page of the document.

Parcel Number Specifications:

- Location requirement: Top left corner of first page

- Universal application: Required for all property transfer deeds

- Tax statement coordination: Links to property tax administration system

- Recording prerequisite: Essential for recording acceptance

Legal Description Requirements

Your quitclaim deed must include a legal description of the property, per Nevada statutory requirements. For a quitclaim deed, you can usually pull the legal description from the existing deed. If you must create a new legal description, you must provide the name and address of the person who created the description.

Legal Description Standards:

- Copy from existing deed: Use exact description from current deed

- Professional preparation: Licensed professional required for new descriptions

- Preparer identification: Name and address of legal description preparer

- Accuracy requirement: Must precisely identify the transferred property

Required Tax Statement Information

No deed shall be accepted unless it contains the name and address of the person to whom a statement of the taxes assessed on the real property is to be mailed. This requirement ensures continuity in property tax administration and prevents disruption in tax collection processes.

Property Description Standards: Legal Descriptions and Recording Requirements

Accepted Legal Description Formats

Nevada accepts standard legal description formats appropriate to the property’s development and surveying history. The state’s diverse geography, from urban Las Vegas subdivisions to rural mining claims, requires flexibility in description methods.

Government Survey System:

- Section, township, and range designations

- Mount Diablo Base and Meridian references (for most Nevada properties)

- Quarter-section and smaller subdivisions

- Specific acreage or lot size designations

Subdivision Descriptions:

- Lot and block numbers within recorded subdivisions

- Subdivision or plat name and recording reference

- Unit numbers for condominium properties

- Planned unit development specifications

Metes and Bounds:

- Precise boundary measurements and directions

- Monument and landmark references

- Point of beginning and proper closure

- Professional surveyor preparation typically required

Special Property Types in Nevada

Nevada’s unique property types require specialized description considerations:

Mining Claims and Unpatented Mines:

- Special exemptions from transfer tax under NRS 375.090

- Unique legal description requirements

- Federal law coordination requirements

Timeshare Properties:

- Specific unit and time period designations

- Resort or development name and location

- Recording reference to master deed or declaration

Condominium Units:

- Unit number and building designation

- Project name and recording reference

- Common area interest percentage

- Homeowners association considerations

Recording Reference Requirements

If a previously recorded document has the same legal description, that document number may be included on the new document to be recorded, in place of the name and address of the person who prepared the legal description. This provision allows efficiency in transfers where legal descriptions have been previously established and recorded.

Signature and Notarization: State-Specific Execution Requirements

Mandatory Notarization Standards

Nevada requires strict compliance with notarization requirements for all quitclaim deeds. According to Nev. Rev. Stat. § 111.105 the quitclaim deed must be signed by the property owner, or grantor. This includes both spouses if the property is co-owned by a married couple, per Nev. Rev. Stat. § 123.230.

Notarization Requirements:

- Grantor signature: All property owners must sign

- Personal appearance: Signers must appear before notary

- Proper identification: Valid government-issued photo identification

- Acknowledgment format: Nevada-specific acknowledgment language

- Notary seal and signature: Complete notarial execution required

Signature Formatting Requirements

Every signature on the quitclaim deed must have the signer’s name printed or typed underneath the original signature, per Nevada Revised Statutes. This requirement ensures clear identification of all parties and prevents confusion in recording and indexing.

Signature Standards:

- Original signatures required: No photocopied signatures accepted

- Printed names: Typed or printed name below each signature

- Legible execution: All signatures must be clearly readable

- Authorized signers only: Only property owners or authorized agents

Community Property Considerations

Nevada’s community property laws create specific signature requirements for married couples. As Nevada is a community property state, a spouse cannot acquire property without the other spouse gaining an ownership interest, which affects signature requirements for property transfers.

Spousal Signature Requirements:

- Joint ownership: Both spouses must sign for community property

- Separate property: Individual spouse may convey separate property alone

- Property characterization: Important to establish separate vs. community property

- Title presumptions: Property acquired during marriage presumed community property

Notary Public Requirements

Nevada maintains specific standards for notaries public performing real estate acknowledgments:

Notary Qualifications:

- Nevada commission: Must be commissioned as Nevada notary public

- Current status: Commission must be active and unexpired

- Proper authority: Must be authorized for real estate acknowledgments

- Identification verification: Must properly identify all signers

Recording Procedures: County Processes, Fees, and Documentation

County Recording Office Procedures

Nevada’s 17 counties each operate recording offices under state standards while accommodating local procedures and geographic challenges. The state’s concentration of population in Clark and Washoe counties creates varying service levels and processing times.

Recording Methods Available:

- In-person submission: Walk-in service during business hours

- Mail submission: Documents sent with proper fees and return instructions

- Electronic recording: Available in some counties through approved vendors

- Drop-off service: Some counties offer secure drop-off options

Recording Fees by County

Recording fees vary by county but are generally reasonable compared to other western states. The only required fee per Nevada statute is a $25 fee for recording the document. Check with your county recorder’s office to learn which other fees may apply.

2025 Fee Examples:

- Clark County (Las Vegas): $42 per document

- Washoe County (Reno): $43 per document

- Most other counties: $25-35 per document

- Additional services: Copy fees, certification fees vary by county

Immediate vs. Delayed Recording

Nevada’s county recording practices vary significantly, particularly between urban and rural counties:

Clark County (Las Vegas Area):

- Immediate recording: Documents recorded instantly and returned same day

- High-volume processing: Equipped for large transaction volumes

- Electronic options: Advanced eRecording capabilities available

Washoe County (Reno Area):

- Delayed return: Takes several weeks to mail back proof of recorded deed

- Standard processing: Traditional recording timeline

- Mail coordination: Proper return address essential

Rural Counties:

- Variable processing: Generally faster than Washoe but slower than Clark

- Limited hours: May have restricted public access hours

- Personal service: Often more personalized attention to individual transactions

Document Formatting Requirements

Nevada maintains specific formatting standards to ensure proper recording and legal compliance. Documents must be clearly readable and capable of producing a legible imaged record.

Formatting Standards (NRS 247.110):

- Paper requirements: White, 20-pound paper, 8½ × 11 inches

- Margin specifications: 1 inch on left, right, and bottom margins

- Top space reservation: 3 × 3 inch space in upper right corner of first page

- Subsequent pages: 1-inch top margin on all pages after first page

- Legibility requirement: Must produce clear, readable copies

Tax Implications: Real Property Transfer Tax and Declaration of Value

Real Property Transfer Tax Overview

The Real Property Transfer Tax (RPTT) applies when real estate ownership is transferred from one party to another. The Nevada Division of Local Government Services oversees its collection across all counties, as outlined in NRS 375. This represents one of Nevada’s few transfer-related taxes, making the state generally transfer-tax-friendly.

RPTT Structure:

- Base rate: $1.95 for every $500 of property value or fraction thereof

- Minimum threshold: No tax on transfers of $100 or less

- County supplements: Additional fees in Clark and Washoe counties

- Calculation method: Based on declared property value

County-Specific Transfer Tax Rates

Nevada allows certain counties to impose additional transfer tax amounts beyond the base state rate:

Enhanced Rate Counties:

- Clark County (Las Vegas): Base $1.95 + $0.60 = $2.55 per $500

- Washoe County (Reno): Base $1.95 + $0.10 = $2.05 per $500

- Churchill County: Base $1.95 + $0.10 = $2.05 per $500

- All other counties: Base $1.95 per $500

Transfer Tax Examples:

- $300,000 property in Las Vegas: ($300,000 ÷ $500) × $2.55 = $1,530

- $300,000 property in Reno: ($300,000 ÷ $500) × $2.05 = $1,230

- $300,000 property in rural county: ($300,000 ÷ $500) × $1.95 = $1,170

Declaration of Value Requirements

Each deed evidencing a transfer of title of real property that is presented for recordation to the county recorder must be accompanied by a declaration of value made on a form prescribed by the Nevada Tax Commission. This form provides essential information for tax calculation and property assessment purposes.

Declaration of Value Form Requirements:

- Mandatory submission: Required for all property transfer deeds

- Nevada Tax Commission form: Must use official state form

- Complete information: All fields must be filled out accurately

- Property valuation: Must declare actual consideration or fair market value

- Exemption claims: Must identify and support any claimed exemptions

Transfer Tax Exemptions

Nevada provides 14 possible exemptions to the Real Property Transfer Tax under NRS 375.090, making many quitclaim deed transactions tax-free:

Common Exemptions for Quitclaim Deeds:

- Family transfers: Between parent and child (first degree lineal consanguinity)

- Spousal transfers: Between husband and wife or former spouses per divorce decree

- Trust transfers: To or from trust without consideration (with certificate of trust)

- Co-owner transfers: Between joint tenants or tenants in common without consideration

- Business entity transfers: Certain transfers between related business entities

- Corrective transfers: Recognizing true status of ownership

Federal Tax Implications

While Nevada imposes minimal transfer-related taxes, federal tax considerations remain important:

Federal Gift Tax:

- Annual exclusion: $18,000 per recipient (2024 amount)

- Spousal transfers: Unlimited between U.S. citizen spouses

- Form 709 requirement: For gifts exceeding annual exclusion

- Lifetime exemption: Substantial federal lifetime gift/estate exemption

Capital Gains Tax:

- Nevada state: No state capital gains tax

- Federal rates: 0%, 15%, or 20% depending on income and holding period

- Primary residence exclusion: Up to $250,000 ($500,000 married) federal exclusion

Special Considerations: Community Property and Las Vegas Market Dynamics

Community Property System Impact

Nevada’s community property laws create unique considerations for quitclaim deed transactions. Nevada recognizes four basic types of ownership: sole ownership, community property, joint tenants, and tenants in common, with community property rules affecting married couples significantly.

Community Property Characteristics:

- Presumption of community property: Property acquired during marriage

- Equal ownership: Both spouses own equal interests in community property

- Management rights: Both spouses have management and control rights

- Disposal restrictions: Generally requires both spouses’ consent for transfers

Property Classification Issues:

- Separate property: Owned before marriage or acquired by gift/inheritance

- Community property: Acquired during marriage with community funds

- Mixed property: Separate property with community contributions

- Transmutation: Converting separate property to community property or vice versa

Las Vegas Metropolitan Area Considerations

The Las Vegas metropolitan area’s unique characteristics create specific opportunities and challenges for quitclaim deed transactions:

Market-Specific Factors:

- High transaction volume: Fast-paced market requires efficient processing

- Investment property prevalence: Significant investor and second-home ownership

- Rapid price appreciation: Frequent property value changes affecting tax calculations

- Tourism industry impact: Seasonal employment affecting family stability and property ownership

Clark County Advantages:

- Immediate recording: Same-day processing and document return

- Advanced technology: Electronic recording and online services available

- Experienced staff: High-volume processing capabilities

- Comprehensive services: Full range of recording and tax services

Nevada Business Entity Considerations

Nevada’s business-friendly environment creates opportunities for property transfers involving business entities:

Business Entity Types:

- Nevada corporations: State incorporation advantages

- Limited liability companies: Flexible ownership and management structures

- Limited partnerships: Investment property holding structures

- Professional entities: Licensed professional property ownership

Transfer Tax Implications:

- 100% ownership transfers: Exempt when person owns 100% of receiving entity

- Change of identity: Exempt for mere changes in business form

- Affiliated entity transfers: Exempt with identical common ownership

- Planning opportunities: Structure transfers to qualify for exemptions

Gaming and Entertainment Industry Property

Nevada’s unique gaming and entertainment industry creates specialized property transfer considerations:

Industry-Specific Issues:

- Gaming license implications: Property transfers may affect gaming licenses

- Regulatory compliance: Gaming Commission approval requirements

- Entertainment venue properties: Specialized zoning and licensing considerations

- Corporate ownership structures: Complex entity ownership patterns

Trust and Estate Planning Integration

Nevada’s favorable trust laws create opportunities for sophisticated estate planning using quitclaim deeds:

Nevada Trust Advantages:

- No state income tax: No taxation of trust income

- Perpetual trusts: Unlimited trust duration allowed

- Asset protection: Strong creditor protection laws

- Privacy protection: Confidential trust administration

Quitclaim Deed Applications:

- Trust funding: Efficient method for transferring property into trusts

- Dynasty trust planning: Multi-generational wealth transfer

- Asset protection strategies: Legitimate creditor protection planning

- Tax optimization: Coordination with federal and state tax planning

Common Mistakes: State-Specific Pitfalls and Prevention Strategies

Declaration of Value Form Errors

Common Declaration Mistakes:

- Failing to submit required Declaration of Value form with deed

- Incorrect property valuation or consideration amounts

- Missing or incorrect exemption claims

- Incomplete form information or signatures

Prevention Strategies:

- Always complete Declaration of Value form for every property transfer

- Research applicable exemptions thoroughly before claiming

- Provide accurate property valuations based on actual consideration or fair market value

- Review form completeness before submission

Assessor Parcel Number Omissions

Frequent APN Mistakes:

- Missing assessor parcel number entirely

- Incorrect placement (not in top left corner of first page)

- Wrong parcel number due to recent property subdivision or combination

- Outdated parcel numbers from previous tax years

Prevention Methods:

- Verify current assessor parcel number through county assessor records

- Place APN in exact location required (top left corner of first page)

- Cross-reference parcel number with property address and legal description

- Check for recent changes in parcel numbering or property boundaries

Community Property Documentation Issues

Common Community Property Errors:

- Inadequate spousal consent for community property transfers

- Confusion about separate vs. community property characterization

- Missing signatures from both spouses when required

- Improper handling of property acquired before marriage

Prevention Approaches:

- Determine property classification (separate vs. community) before transfer

- Obtain both spousal signatures for community property transfers

- Document separate property character with supporting evidence

- Consult family law attorney for complex marital property situations

Recording Format and Fee Compliance

Frequent Recording Mistakes:

- Incorrect margin measurements or paper size

- Missing required spaces for recording stamps

- Insufficient fees for recording and transfer tax

- Wrong county for recording submission

Quality Control Measures:

- Use Nevada-specific forms with proper formatting

- Verify margin requirements and space reservations

- Calculate fees accurately including transfer tax

- Confirm property location and appropriate county for recording

Transfer Tax Calculation Errors

Tax Compliance Mistakes:

- Incorrect transfer tax calculations based on property value

- Missing county supplement amounts for Clark or Washoe counties

- Claiming inappropriate exemptions without proper documentation

- Undervaluing property to reduce transfer tax liability

Tax Management Strategies:

- Use county-specific transfer tax calculators when available

- Research exemption eligibility thoroughly with supporting documentation

- Provide honest property valuations based on actual consideration

- Consult tax professional for complex valuation issues

Las Vegas Market-Specific Issues

Market-Related Mistakes:

- Underestimating rapid property value changes in Las Vegas market

- Inadequate due diligence on investment properties

- Missing gaming or entertainment industry regulatory requirements

- Poor timing of transfers during market volatility

Market-Specific Strategies:

- Stay current on Las Vegas market values and trends

- Conduct thorough due diligence on all property characteristics

- Research any special licensing or regulatory requirements

- Consider market timing for tax and financial optimization

Professional Resources: When to Consult Experts and Local Authorities

Legal Professional Consultation

Nevada’s community property laws, gaming industry considerations, and dynamic real estate markets often require professional legal guidance for optimal outcomes.

When to Engage Real Estate Attorneys:

- Complex community property characterization issues

- Gaming or entertainment industry property transfers

- High-value Las Vegas real estate transactions

- Business entity property transfers requiring tax planning

- Properties with title defects or ownership disputes

Attorney Selection Criteria:

- Nevada State Bar membership and good standing

- Real estate law specialization with Nevada experience

- Community property law expertise

- Gaming law knowledge for industry-related properties

- Las Vegas market familiarity for metropolitan area transactions

Title Insurance and Professional Services

Nevada’s active title insurance market provides comprehensive services well-suited to quitclaim deed transactions.

Title Company Services:

- Title searches: Comprehensive ownership and lien research

- Title insurance: Protection against unknown defects and claims

- Escrow services: Professional handling of transfer documents and funds

- Recording coordination: Expert document preparation and submission

- Community property analysis: Assistance with property characterization

Title Insurance Benefits:

- Routine quitclaim coverage: Nevada title companies readily insure quitclaim transfers

- Comprehensive protection: Coverage against title defects and ownership disputes

- Professional claims handling: Expert resolution of title issues

- Extended coverage options: Enhanced protection for high-value properties

County-Specific Resources and Contacts

Nevada’s counties provide specialized services adapted to local market conditions and requirements.

Major County Recording Offices:

- Clark County (Las Vegas): (702) 671-0600

- Washoe County (Reno): (775) 328-3661

- Carson City: (775) 887-2260

- Lyon County: (775) 463-6581

- Douglas County: (775) 782-9025

Available County Services:

- Document formatting assistance: Guidance on recording requirements

- Transfer tax calculation: Help with tax computation and exemptions

- Recording fee information: Current fee schedules and payment methods

- Public record research: Historical document research and copies

- Declaration of Value support: Forms and completion assistance

Gaming and Entertainment Industry Specialists

Nevada’s unique gaming and entertainment industry may require specialized professional guidance for property transfers.

Industry-Specific Resources:

- Gaming attorneys: Legal counsel for gaming-related property issues

- Gaming consultants: Regulatory compliance and licensing guidance

- Entertainment law specialists: Venue and production facility expertise

- Regulatory compliance consultants: Gaming Commission and local authority coordination

Tax and Financial Planning Professionals

Nevada’s favorable tax environment and complex transfer tax system benefit from professional tax guidance.

Tax Professional Services:

- Transfer tax specialists: Expert calculation and exemption analysis

- Estate planning attorneys: Coordination with trust and estate strategies

- Tax preparers: Federal gift tax and capital gains planning

- Financial planners: Integration with overall wealth management strategies

Real Estate Market Specialists

Las Vegas and Nevada’s dynamic real estate markets benefit from specialized market knowledge.

Market Professional Services:

- Real estate appraisers: Professional property valuation for transfer tax purposes

- Market analysts: Las Vegas and Nevada market trend analysis

- Investment advisors: Real estate investment strategy and planning

- Property managers: Ongoing property management and oversight

Step-by-Step Process: Complete Procedure Specific to Nevada State

Phase 1: Pre-Transfer Planning and Research

Step 1: Property Analysis and Community Property Determination

- Obtain current title report or previous deed information

- Determine community property vs. separate property classification

- Verify assessor parcel number and current property tax information

- Research any liens, encumbrances, or title issues

- Identify any gaming or entertainment industry regulatory considerations

Step 2: Transfer Tax and Exemption Planning

- Research applicable transfer tax exemptions under NRS 375.090

- Calculate potential Real Property Transfer Tax based on property value

- Determine county-specific transfer tax rates (Clark, Washoe, or standard)

- Plan timing for optimal tax treatment and market conditions

- Consider federal gift tax implications for family transfers

Step 3: Legal Description and Recording Preparation

- Verify legal description accuracy against current recorded documents

- Confirm assessor parcel number matches property records

- Research any recent property subdivision or boundary changes

- Identify appropriate county recorder office for property location

- Determine recording method (in-person, mail, or electronic where available)

Phase 2: Document Preparation and Compliance

Step 4: Quitclaim Deed Drafting

- Use Nevada-compliant quitclaim deed form meeting formatting requirements

- Include complete grantor and grantee identification information

- Insert accurate legal description and assessor parcel number

- Add proper tax statement mailing address as required

- Include consideration amount and execution date

Step 5: Declaration of Value Form Completion

- Obtain current Nevada Tax Commission Declaration of Value form

- Complete all required fields with accurate property and transaction information

- Calculate transfer tax amount or identify applicable exemption

- Gather supporting documentation for any claimed exemptions

- Ensure form meets recording standards and requirements

Step 6: Community Property and Spousal Consent Coordination

- Determine spousal signature requirements based on property classification

- Prepare any necessary community property acknowledgments

- Coordinate signing by all required parties

- Address any separate property characterization issues

- Plan notarization logistics for all required signers

Phase 3: Execution and Notarization

Step 7: Document Execution Coordination

- Schedule notarization appointment ensuring all grantors available

- Gather valid government-issued identification for all signers

- Ensure voluntary execution by all required parties

- Coordinate spousal consent and community property considerations

- Review documents for completeness before execution

Step 8: Notarization and Acknowledgment Process

- Execute deed in presence of qualified Nevada notary public

- Provide proper identification and verification for all signers

- Ensure signatures are printed or typed beneath original signatures

- Obtain complete notarial acknowledgment with seal and signature

- Review completed documents for accuracy and compliance

Phase 4: Recording and Completion

Step 9: Recording Fee and Tax Calculation

- Calculate exact recording fees based on county requirements

- Compute Real Property Transfer Tax including any county supplements

- Prepare payment using county-accepted methods

- Assemble complete recording package including Declaration of Value

- Verify all required documents and fees included

Step 10: County Recording and Post-Recording Activities

- Submit quitclaim deed and Declaration of Value to appropriate county recorder

- Pay all recording fees and transfer taxes

- Obtain recording receipt and confirmation

- Track processing status based on county procedures (immediate vs. delayed)

- Distribute recorded copies to relevant parties and update records

Timeline Management and County Considerations

Clark County (Las Vegas) Timeline:

- Same-day processing: Documents recorded and returned immediately

- Preparation time: 1-3 days for document preparation

- Execution time: 1 day for notarization and completion

- Total timeline: 2-4 days from start to recorded deed in hand

Washoe County (Reno) Timeline:

- Extended processing: Several weeks for mailed return of recorded deed

- Preparation time: 1-3 days for document preparation

- Execution time: 1 day for notarization and completion

- Total timeline: 3-5 weeks from start to recorded deed return

Rural County Timeline:

- Variable processing: Generally 1-2 weeks for document return

- Limited hours: May require appointment or specific submission times

- Personal service: Often more individualized attention and assistance

- Total timeline: 1-3 weeks depending on county and submission method

Quality Assurance Final Checklist

Document Completeness and Accuracy:

- ✓ All required grantor and grantee information included

- ✓ Accurate legal description verified against current records

- ✓ Assessor parcel number included in top left corner of first page

- ✓ Tax statement mailing address provided

- ✓ Proper consideration amount stated

- ✓ Community property issues addressed appropriately

Form and Tax Compliance:

- ✓ Declaration of Value form completed accurately

- ✓ Transfer tax calculated correctly including county supplements

- ✓ Applicable exemptions identified and documented

- ✓ Nevada formatting requirements met (margins, paper, spacing)

- ✓ All required signatures properly notarized

- ✓ Printed names included beneath all signatures

Recording Readiness:

- ✓ Correct county identified for recording submission

- ✓ Proper recording fees calculated and payment prepared

- ✓ All required documents assembled in proper order

- ✓ Return address and contact information provided

- ✓ County-specific requirements verified and met

Conclusion: Ensuring Successful Nevada Quitclaim Deed Transfers

Nevada’s combination of community property laws, reasonable transfer taxes, and efficient recording procedures creates an favorable environment for quitclaim deed transactions. The state’s immediate recording in Clark County and routine title insurance coverage for quitclaim transfers make Nevada particularly attractive for property transfers requiring speed and efficiency.

Success in Nevada quitclaim deed transactions requires careful attention to the state’s community property laws, Declaration of Value requirements, and county-specific procedures. The Las Vegas market’s fast pace and high transaction volume demand precision in document preparation and execution, while Nevada’s transfer tax exemptions provide significant opportunities for cost savings in family and business transfers.

By understanding Nevada’s specific requirements, utilizing available resources, and following proper procedures, property owners can achieve efficient transfers while avoiding common pitfalls. The state’s combination of business-friendly laws and reasonable costs makes it an ideal jurisdiction for both residential and investment property transfers.

For those seeking professional assistance with Nevada quitclaim deed preparation and recording, Deeds.com offers comprehensive services tailored to Nevada’s unique requirements, ensuring compliance with current laws and optimal outcomes for your property transfer objectives.

This guide provides general information about Nevada quitclaim deed requirements and should not be considered legal advice. Property transfer situations involve unique circumstances that may require professional consultation. Always verify current requirements with appropriate county authorities and consider consulting qualified legal professionals for complex transactions involving community property, gaming industry properties, or high-value Las Vegas real estate.

Leave a Reply